Don’t miss this Monthly Interest On $400 000 Savings article containing the interesting information you’re looking for, all carefully summarized by us.

Monthly Interest on $400,000 Savings: Maximizing Your Returns

In the realm of personal finance, earning interest on your savings is a cornerstone of wealth accumulation. With a substantial sum like $400,000 at your disposal, the potential for monthly interest earnings can be significant. Embark on a journey to explore the intricacies of interest rates, savings accounts, and strategies to maximize your financial returns.

In this article, we will delve into the world of savings interest, providing you with a comprehensive guide to calculating your monthly earnings, understanding the factors that influence interest rates, and offering expert advice to optimize your savings strategy. Whether you’re a seasoned investor or just starting to build your financial foundation, this guide will empower you to make informed decisions and enhance your financial well-being.

Understanding Savings Interest Rates

Interest rates are the percentage of your savings that you earn over time. They are typically expressed as an annual percentage yield (APY), which takes into account the compounding effect of interest. The higher the APY, the more interest you will earn on your savings. Interest rates are set by banks and financial institutions and are influenced by various factors, including economic conditions, inflation, and the Federal Reserve’s monetary policy.

When comparing savings accounts, it’s crucial to look beyond the headline APY and consider other factors such as fees, minimum balance requirements, and withdrawal restrictions. A higher APY may not necessarily translate into higher earnings if these other factors are not favorable.

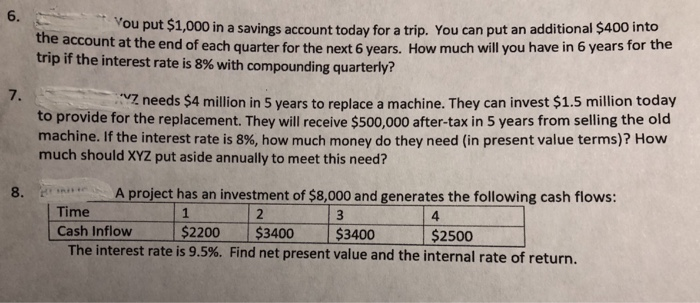

Calculating Your Monthly Interest Earnings

To calculate your monthly interest earnings, simply divide your savings balance by 12 and multiply the result by the annual interest rate (APY). For example, if you have $400,000 in a savings account with an APY of 2%, your monthly interest earnings would be:

Monthly interest earnings = ($400,000 / 12) x 0.02 = $666.67

It’s worth noting that interest earnings are typically credited to your account at the end of each month, so you may not see the full amount reflected in your balance until the beginning of the following month.

Maximizing Your Savings Returns

Maximizing your savings returns requires a combination of strategic decisions and diligent monitoring. Here are some expert tips to help you optimize your savings strategy:

- Choose the right savings account. Compare different savings accounts to find the one that offers the highest APY while also meeting your other needs.

- Maintain a healthy savings balance. The more money you have in your savings account, the more interest you will earn.

- Consider a high-yield savings account. These accounts typically offer higher APYs than traditional savings accounts but may have additional requirements, such as minimum balance or withdrawal restrictions.

- Use a money market account. Money market accounts offer higher interest rates than savings accounts but may have higher minimum balance requirements.

- Invest in certificates of deposit (CDs). CDs offer fixed interest rates for a set period of time, which can provide a guaranteed rate of return.

Remember that interest rates can fluctuate over time, so it’s essential to monitor your savings account regularly and adjust your strategy as needed. By following these tips, you can maximize your returns and grow your wealth over the long term.

FAQs on Savings Interest

- Q: What factors affect interest rates?

A: Interest rates are influenced by economic conditions, inflation, and the Federal Reserve’s monetary policy.

- Q: How often are interest earnings credited to my account?

A: Interest earnings are typically credited to your account at the end of each month.

- Q: What is the best way to maximize my savings returns?

A: Choose the right savings account, maintain a healthy savings balance, consider a high-yield savings account or money market account, and invest in certificates of deposit.

Conclusion

Earning interest on your savings is a powerful tool for building wealth and achieving your financial goals. By understanding savings interest rates, calculating your monthly earnings, and maximizing your savings strategy, you can optimize your returns and secure your financial future. Remember to monitor your savings account regularly and adjust your strategy as needed to keep pace with changing interest rates. Whether you’re just starting out or looking to enhance your savings plan, the insights and tips provided in this guide will empower you to make informed decisions and grow your wealth.

Are you interested in learning more about savings interest and other personal finance topics? Visit our blog for a wealth of information and expert advice to help you achieve your financial goals.

Image: www.discover.com

An article about Monthly Interest On $400 000 Savings has been read by you. Thank you for visiting our website, and we hope this article is beneficial.

Azdikamal.com Trusted Information and Education News Media

Azdikamal.com Trusted Information and Education News Media