Find the latest information about Disadvantages Of Transfer On Death Deed in this article, hopefully adding to your knowledge.

Disadvantages of Transfer on Death Deed

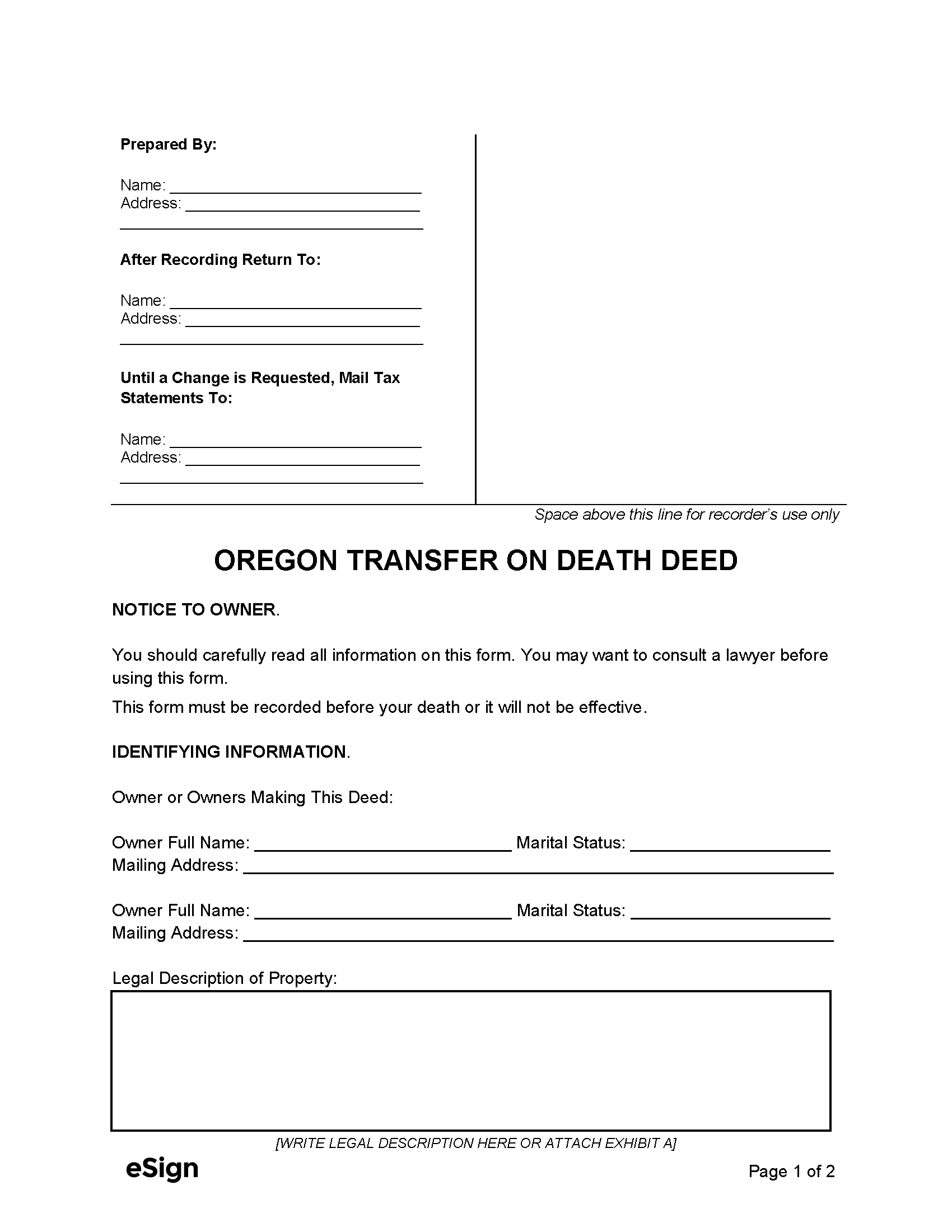

Many people are familiar with a will as a tool to transfer property upon death. Another estate planning tool is a transfer on death deed. Unlike a will that goes through probate, a transfer on death deed allows an individual to transfer real estate to a beneficiary without probate. However, there are several disadvantages to using a transfer on death deed instead of a will.

There are several reasons why a person might choose to use a transfer on death deed. They are relatively easy to create. The individual simply needs to fill out a form and file it with the county recorder’s office. Transfer on death deeds avoid probate, which can be a time-consuming and expensive process. Additionally, transfer on death deeds are not subject to challenge by creditors, which can be a concern for individuals who are concerned about protecting their assets.

Disadvantages of Transfer on Death Deeds

1. Loss of Control: Once a transfer on death deed is created, the individual gives up all control over the property. The beneficiary becomes the owner of the property immediately, but the transfer does not take effect until the individual’s death. This means that the individual can no longer sell, mortgage, or otherwise dispose of the property.

2. Inability to Change Beneficiary: Once a transfer on death deed is created, the individual cannot change the beneficiary without the consent of the beneficiary. This can be a problem if the individual changes his or her mind about who they want to inherit the property.

3. No Protection for Creditors: Transfer on death deeds do not protect the property from creditors. If the individual has debts, the creditors can still make a claim against the property after the individual’s death.

4. Potential Tax Consequences: Transfer on death deeds can have negative tax consequences. If the value of the property increases after the transfer on death deed is created, the beneficiary may have to pay capital gains tax on the appreciation when they sell the property.

5. Lack of Flexibility: Transfer on death deeds are not as flexible as wills. A will allows the individual to specify how the property will be distributed and to create trusts for the benefit of beneficiaries. These options are not available with a transfer on death deed.

Protecting Assets

If the individual is concerned about protecting assets from creditors, there are other estate planning tools that can be used, such as a living trust. A living trust is a legal document that creates a trust during the individual’s lifetime. The individual transfers assets to the trust, and the trustee manages the assets according to the individual’s instructions. Unlike a transfer on death deed, a living trust allows the individual to retain control over the assets during their lifetime. Additionally, living trusts are not subject to challenge by creditors.

Transfer on death deeds can be a useful estate planning tool, but they are not without their drawbacks. Individuals who are considering using a transfer on death deed should carefully weigh the advantages and disadvantages before making a decision.

FAQ

Q: What is a transfer on death deed?

A: A transfer on death deed is a legal document that allows an individual to transfer real estate to a beneficiary without probate.

Q: What are the advantages of using a transfer on death deed?

A: Transfer on death deeds are relatively easy to create, avoid probate, and are not subject to challenge by creditors.

Q: What are the disadvantages of using a transfer on death deed?

A: Transfer on death deeds can result in a loss of control over the property, inability to change beneficiary, no protection for creditors, potential tax consequences, and lack of flexibility.

Q: Are there other estate planning tools that can be used to protect assets from creditors?

A: Yes, a living trust is a legal document that creates a trust during the individual’s lifetime. The individual transfers assets to the trust, and the trustee manages the assets according to the individual’s instructions.

Conclusion

Transfer on death deeds can be a useful estate planning tool, but they are not without their drawbacks. Individuals who are considering using a transfer on death deed should carefully weigh the advantages and disadvantages before making a decision.

Are you interested in learning more about transfer on death deeds?

Image: esign.com

We express our gratitude for your visit to our site and for reading Disadvantages Of Transfer On Death Deed. We hope this article is beneficial for you.

Azdikamal.com Trusted Information and Education News Media

Azdikamal.com Trusted Information and Education News Media